- #File extension 2016 taxes for free#

- #File extension 2016 taxes professional#

- #File extension 2016 taxes series#

The fastest and easiest way to get the extra time is through the Free File link on IRS.gov. What is the easiest way to file a tax extension? So if you’re filing 2020 taxes but miss filing by May 17, 2021, you still have until November 2021 to e-file. The IRS announces in October when exactly it will stop accepting e-filed returns for that tax year. Filing your return electronically is faster, safer and more accurate than mailing your tax return because it’s transmitted electronically to the IRS computer systems.

#File extension 2016 taxes series#

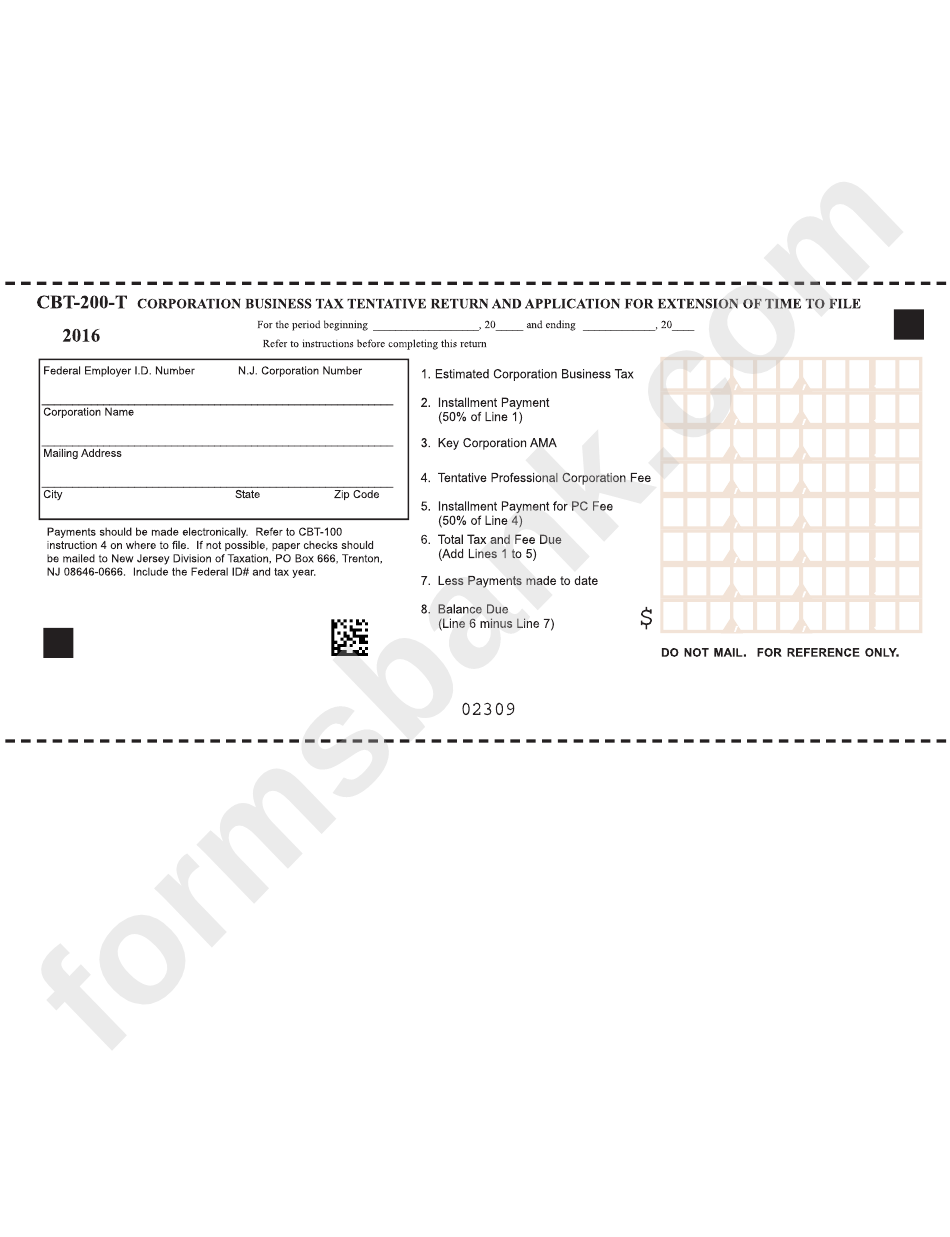

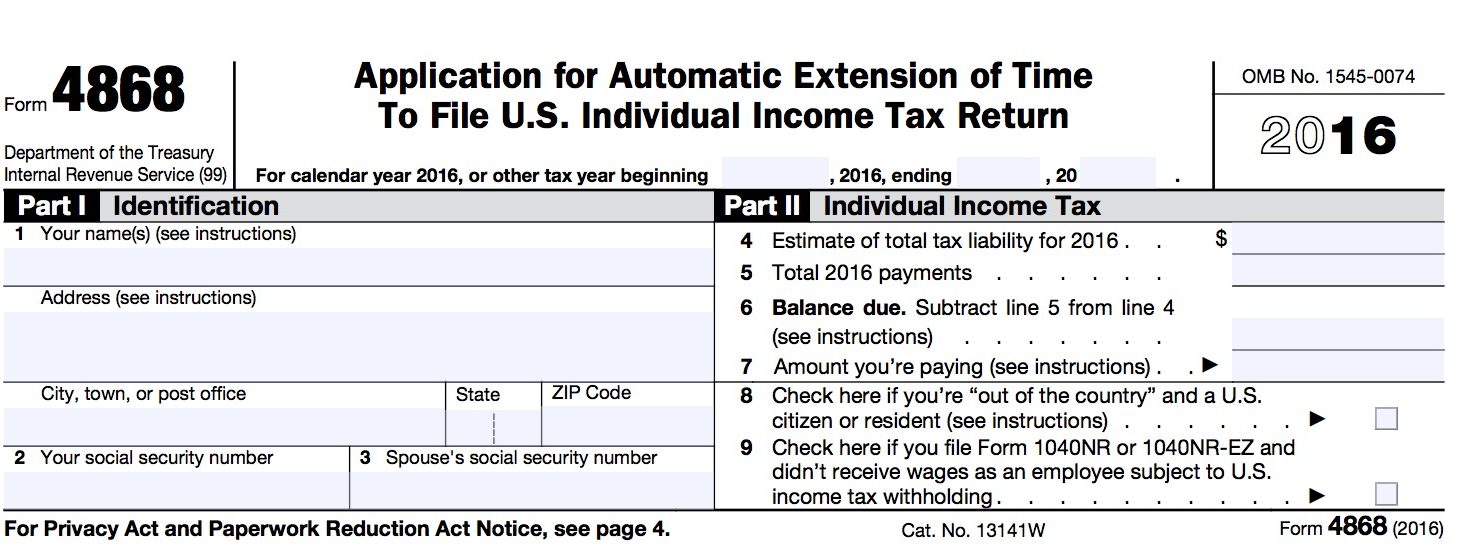

Yes, you can file an original Form 1040 series tax return electronically using any filing status. To get the extension, you must estimate your tax liability on this form and should also pay any amount due.Ĭan I still file my 2016 taxes electronically? Filing this form gives you until October 15 to file a return. Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. You’ll receive an electronic acknowledgment once you complete the transaction. You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. IRS e-file is the IRS’s electronic filing program. Then, submit your tax return for e-file! Our customer service representatives are here to assist you if you have any questions.You can file a paper Form 4868 and enclose payment of your estimate of tax due. We’ll let you know what credits you’re eligible for.

Gather your income statements to enter your sources of income. Enter your basic information such as your name, social security number, address, filing status, and more. Simply, select your tax year from the drop down menu to create a username and password. Apis the last day that you are able to claim your 2020 tax refund.On November 1, 2023, e-filing of 2020 tax returns will be closed for good.E-filing of 2020 tax returns resumes on January 31, 2023.

From Novemto January 30, 2023, 2020 tax returns must be paper filed.On FebruPriorTax will commence the e-file of 2020 tax returns.

#File extension 2016 taxes professional#

For complex tax returns, purchase a professional review or a CPA review to ensure your tax return is completely accurate. If you’re confused about your tax situation before finalizing our return, reach out to us by email, live chat, or give us a call. For an in-depth review, we offer a professional review or CPA review service, which includes a phone consultation.īefore submitting your tax return information for filing, you can save your changes and log back in to continue where you left off.

#File extension 2016 taxes for free#

Unlike other tax sites, you can contact our tax experts by phone, email or live chat for free if you need tax advice. All you need to do is provide your basic information, income statements, deductions, credits and submit your account for filing! Your tax refund or tax due will automatically be calculated within your account while entering your tax information. Filing your tax return has never been easier.Here’s what you need to know about using Priortax: The federal e-file tax deadline is Monday, October 17. You may also opt to paper-file your tax return using our site. You may still prepare your 2020 taxes using our website and e-file once it is available. The IRS will accept e-filed returns on Februthrough October 15, 2021. Start your 2020 tax return online and submit it for filing.*

0 kommentar(er)

0 kommentar(er)